Thursday, 23 February 2012

Crime Figures: DECEMBER 2011

Our Local Police Officers

Saturday, 18 February 2012

Video Update: 17 Weeks to completion

The next public meeting of Stonebridge Park Tenants & Residents Association is at 7pm on Wednesday 7th March at Stonebridge Farm; you may contact SPTRA by e-mail at: stonebridgetra@gmail.com.

OVER £2 million of revenue has been raised by LHA_ASRA through the sale of 22 houses on the Stonebridge Park Estate in just one month !

An independent developer came forward in January who expressed an interest in building up to 20 new houses in Limmen Gardens within Phase 2 of the development area, side of Blue Bell Hill Community centre. In addition landlord Nottingham City Homes still wants to build houses on Stonebridge Park as part of its new house building programme announced in autumn 2011. Its short list of possible sites has now been reduced to 25 from the original 40 areas around Nottingham.

There are presently 61 houses in the consultation process ear-marked for environmental improvements, and Nottingham Energy Partnership, along with another organisation has now agreed to fund free external wall cladding for home owner occupiers, which is really good news.

The latest video update begins at the top of Magson Close, then Rocket Park, Flewitt Gardens, Dennet Close, Lytton Close, Eastham Close, Peveril pub site, and then views around the same area; It was a lovely mild day with blue skies.

Thursday, 16 February 2012

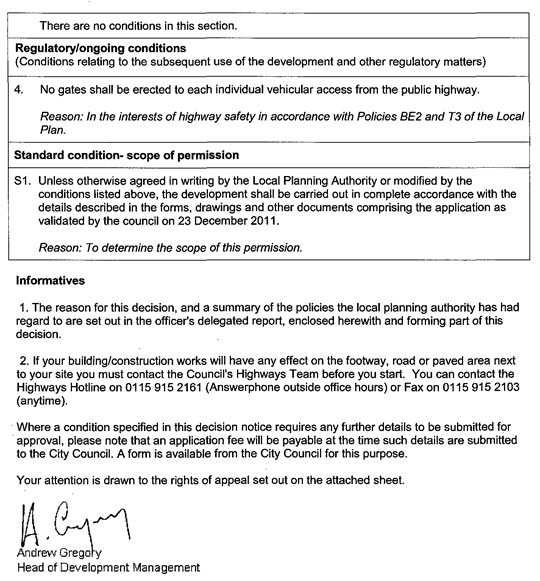

Lytton Close & Eastham Close ~ Approved

Wednesday, 15 February 2012

CHEAP HOME LOANS FOR 5 YEARS

ELEVEN New houses have so far been sold on the Stonebridge Park Estate, If you are interested in buying one of the new houses here, best hurry! There is good news about low interest Rates, says: Richard Pearson.

-----------------------------------------------------------------------------------------------------------

By Alison Little and Sarah O’Grady

MILLIONS of homeowners will enjoy cheap mortgages for another five years thanks to record low interest rates, experts predicted last night.

Optimism rose in the wake of economic forecasts from the Bank of England – although the news was bad for savers.

The Bank’s Governor Sir Mervyn King hinted yesterday that the base rate will stay at its historic 0.5 per cent low until at least 2014, while others forecast it would last up to 2017. But while that means low-cost home loans it spells disaster for savers like pensioners who rely on nest-eggs for income.

Sir Mervyn was accused of “sacrificing savers” by claiming raising interest rates would drag the UK back into recession.

The Governor said he felt “deep sympathy” for those getting near-zero returns on their investments but their suffering was part of the “painful adjustment” needed for long-term economic health.

The Bank stuck by previous forecasts of low growth but said there was now a less severe risk of Britain returning to recession in the first half of this year.

Bank of England Governor Sir Mervyn King was accused of “sacrificing savers” by claiming raising interest rates would drag the UK back into recession.

Sir Mervyn said the economy was “moving in the right direction” although it would “zigzag” in and out of growth in 2012 and faced “choppy waters” including the risk from the Eurozone crisis.

Growth of about one per cent was expected this year and 1.8 per cent in 2013. Inflation, which fell last month to 3.6 per cent, was predicted to hit the official two per cent target at the end of this year. It will then drop to as low as 1.5 per cent the following year.

Sir Mervyn said that while increasing the base rate to four or five per cent would give an impression of higher savings returns, it would also reduce asset values, investment and consumer spending – and trigger a return to recession.

He said: “Many savers would find that the value of their wealth would fall more than enough to offset the apparently higher yield and everyone would be worse off.

“All groups in society are suffering from the consequences of the financial crisis.

“Our judgment has to be what is the right course of action eventually to steer the economy back to low inflation, close to the target, and steady growth.’’

Howard Archer, of IHS Global Insight, said: “We are sticking to our view that interest rates will not rise until at least late 2013 and could very well stay at 0.5 per cent until 2014.”

The Centre for Economics and Business Research think-tank believed the rate would stay at 0.5 per cent until 2016.

Sunday, 5 February 2012

Stonebridge Snow Scenes

There was significant snowfall yesterday evening, and this was a good opportunity to record snow scenes around Stonebridge Park. According to the Evening Post 10 houses have now been sold on the estate over the last 7 days, raising about £1m in revenue for Developer Leicester Housing Association, which is a not for profit organisation.

Street lighting has now been installed on the Long Hedge site at the top of Magson Close, and roofs were now being put onto the block of flats on Magson Close itself.